Community Is Our Middle Name

We CU strengthening your community. From classrooms to food drives to local festivals and supporting small businesses, we're proud to see - and serve - the people who make our communities shine.

Neighbors Helping Neighbors

At 1st Community Credit Union, community is at the heart of what we do. When our communities thrive, we all succeed. That's why our employees volunteer, support local initiatives, and celebrate the people who make this area home. Over the past several years our staff has logged over 4600 volunteer hours in our local communities.

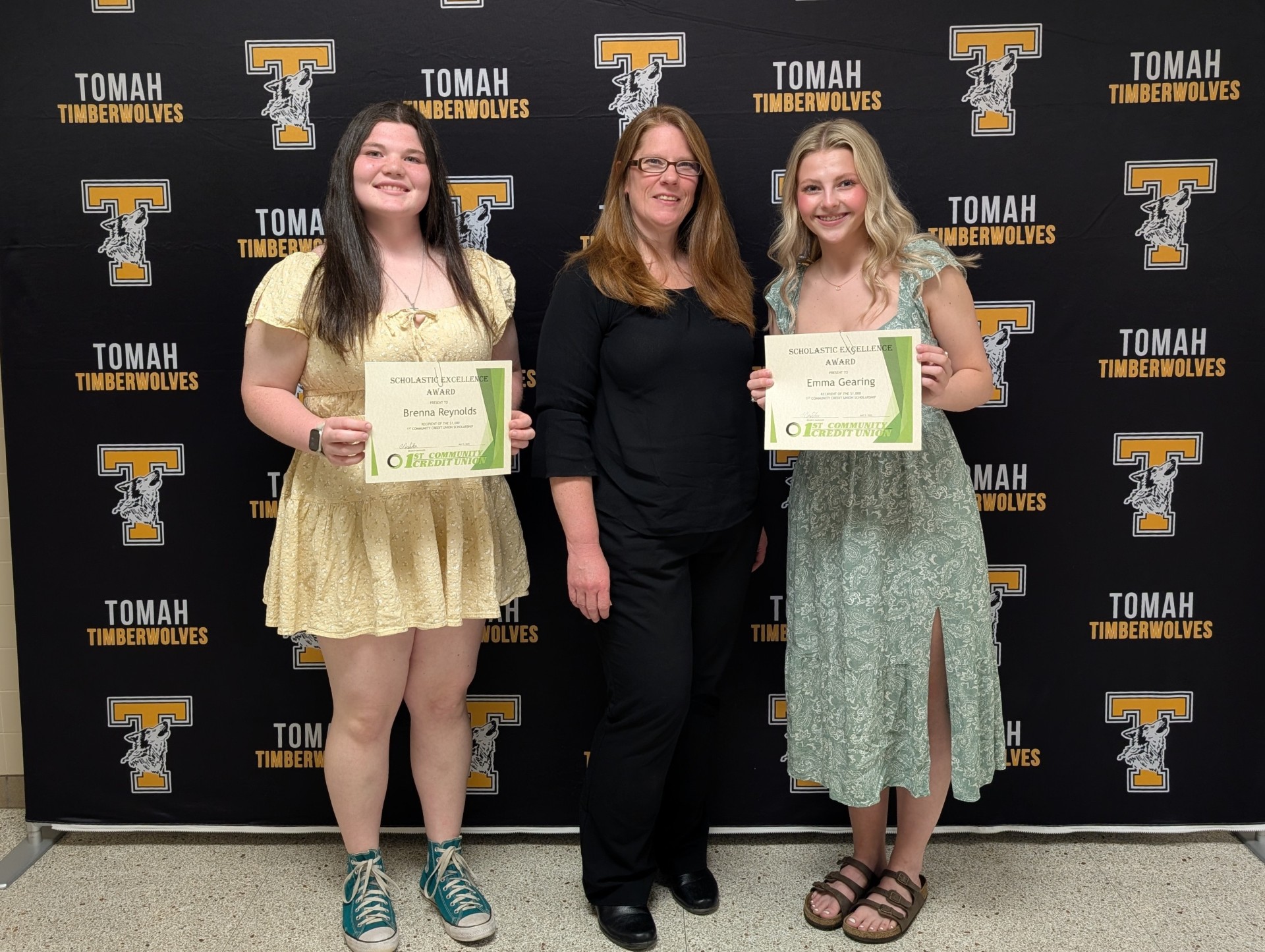

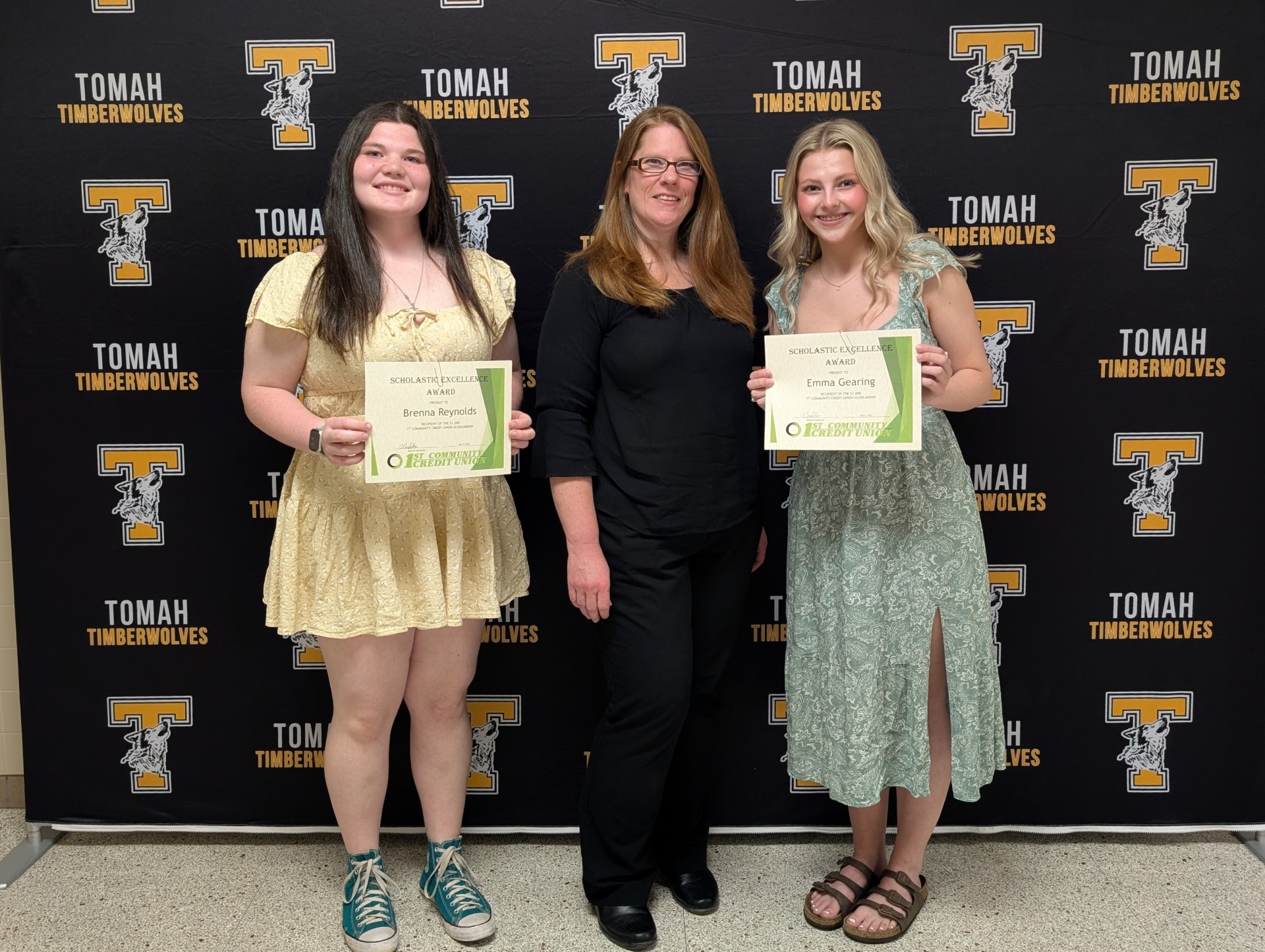

Strong Students, Strong Communities

At 1st CCU we believe in supporting the next generation. Each year we award $1,000 scholarships to our Student Tellers and to a graduating senior from SHS, WSHS, and THS. It's one more way we invest in our communities' future.

Who can join?

Anyone who lives or works in Monroe, La Crosse, Trempealeau, Jackson, Buffalo, Eau Claire, Clark, Wood, Juneau, Adams, Sauk, Richland, Vernon or Crawford County is eligible to join 1st CCU. Members of your immediate family are also eligible to join.

(Immediate family includes the spouse, parent, children, stepparents, stepchildren, grandparents and grandchildren of each person eligible to be a member of the Credit Union)

Local ResourcesLocal Resources

Coulee Cap:

-

Website: https://couleecap.org/

-

Couleecap connects people with programs for housing, food, energy, and job support—helping individuals and families in Southwest Wisconsin move toward lasting stability and independence.

Monroe County Community Resource Guide:

La Crosse County Resource Center:

Local Resources

Coulee Cap:

-

Website: https://couleecap.org/

-

Couleecap connects people with programs for housing, food, energy, and job support—helping individuals and families in Southwest Wisconsin move toward lasting stability and independence.

Monroe County Community Resource Guide:

La Crosse County Resource Center: