1st CCU Anywhere FAQ's

HOW DO I LOG INTO 1ST CCU ANYWHERE?

What you need to know when registering for 1st CCU Anywhere:

- You will be prompted to enter information to confirm your identity.

- You'll enter your SS#, your 8-digit Member Number, the email address listed on your 1st CCU account, and the phone number listed on your 1st CCU account.

- If the information you enter for enrollment does not match the information listed on your account, please contact 1st CCU to update your contact information.

- Once you've confirmed your identity and completed the login process you will create a Username and Password.

- Once accepted, your 1st CCU Anywhere Dashboard will display. The same login credentials are used whether you are logging into Online Banking or the Mobile App.

Step 1 for Online Users: Go to 1stccu.com and click the Log In button in the upper right corner, then use the Login screen to enter our User Name, then your Password. If you are not yet enrolled in 1st CCU Anywhere, click the link titled First time user? Enroll now. I’ve highlighted the sentences that need to be replaced on the screenshot below.

Step 1 for Mobile Users: After downloading the 1st CCU Anywhere mobile app, tap the icon on your mobile device and enter your Username and Password in the fields provided.

2: Enter your email address and a phone number where you can receive a text or phone call to obtain a verification code

3: Select how you would like to receive your verification code.

TEXT: You will receive a text containing a 6-digit verification code. The code is valid for 3-5 minutes.

PHONE: You will receive a phone call and an automated voice will read the code to you (you may want to have a pen and paper handy to jot down the code). The code is valid for 3-5 minutes.

Without closing your browser, obtain the verification code you received via text or phone call.

4: When you've received the verification code, enter the code in the field provided. (Note: some mobile devices have a feature that allows the phone to auto-populate the verification code when you open the text).

If you trust the computer you are using to log into Online Banking, check the box for "Don't ask for code again on this computer". This authorizes the system to remember your computer or device (this option should never be selected on a public computer).

When you have entered the verification code and/or checked the box, click Verify.

5: Review the User Agreement and click Accept

6: You will be taken to your new Dashboard.

The steps shown above are for first-time logins. If you have checked the box authorizing the system to remember your device, you will not need to receive the verification code for subsequent logins.

User Names must meet these parameters:

- must be at least 6 characters in length and less than 20 characters.

- must start with a letter

- must contain only letters A-Z and/or numbers 0-9*

NOTE: Your User Name is not allowed to contain symbols or punctuation such as @, ! . _ * - # " (), etc.

Passwords must meet these parameters:

- Be 10-20 characters in length

- Contain at least one Capital Letter

- Contain at least one Number

- Contain at least one Special Character (examples: !"#$%(*)+,-/;<=>?[\]^_'{}`)

- Cannot match or include your Online Banking User Name

- You cannot use your previous 2 passwords when changing a password

Your security is our priority: For your protection you will periodically be prompted to change your 1st CCU Anywhere password.

What If I Can't Remember My Username And Password?

- Click the 'Forgot?' link for self-service account recovery.

- The system will ask you to provide verification of your identity, and will attempt to validate the information by comparing it to the information listed on your 1st CCU account. (If you've tried self-service recovery and you aren't able to gain access please contact 1st CCU's Call Center at 888-706-1228).

What is Two-Factor Authentication?

It's a security feature to protect your account information. You need to enroll an email address and a phone number (it can be your mobile phone or your landline phone). Once your provided this information within the login process you'll choose your preferred option (text or phone call) to receive a one-time verification code.

How much time do I have to enter the two-factor authorization code?

Codes are valid for 3-5 minutes and will expire after that time.

Can I receive the two-factor authentication code via email?

- No, you are asked to enter your email address during the authentication step, but you cannot receive the verification code via email. Please select Text or Phone.

- The phone number you enter on the two-factor authentication screen should be a mobile phone or landline that you have immediate access to in order to receive the texted code, or if you selected to receive the code via Phone you will receive an automated phone call and a recorded voice will verbally provide the code.

- Remember to click the "Don't ask for code again on this computer" if you trust your computer and you wish to bypass this step in the future.

What should I do if I did not receive a verification code to continue with the two-factor authentication?

Please be sure the phone number you entered is correct. If it needs to be changed, contact a 1st CCU Call Center Representative at 888-706-1228. The system also verifies that the email you entered matches the email listed on your account. Please be sure you are entering the email address listed in your account on 1st CCU's computer system.

Will I need to go through the Two-Factor Authentication every time I log in?

The first time you log into the Online Banking system, if you are logging in from a secure computer, you have the option to select "don't ask for code again on this computer". This allows you to avoid having to enter a verification code during each login. This option should never be selected on a shared or public computer. (Note: for security purposes we don't recommend allowing your computer to save your username and password).

If I selected "remember this computer", why am I being asked for a verification code each time I log in?

Possible reasons include:

- You are logging in on different browsers

- You have deleted your browser history since your last login

- You have your browser settings set to delete your cookies and history automatically

Can I lock myself out by entering an incorrect verification code?

Lockouts can happen, it's a security feature to protect your accounts.

- You can get locked out if too many attempts are made with an incorrect code.

- You can get locked out if you make more than 20 unsuccessful attempts in a 24-hour period.

How does the phone call two-factor authentication process work?

If you select to receive a phone call (mobile phone or landline phone) you will enter a specific digit, as directed, before the verification code is provided. If you have selected phone call verification and you do not answer the phone call, please note that a second call will not be made automatically and the system will NOT leave codes on a voicemail. If you do not answer, you will need to select the option to have the code re-sent. (Note: The "from" phone number may be listed as incoming from anywhere in the United States.)

Your 1st CCU Anywhere dashboard is customizable. You may move the menu card around so the ones that are most important to you are at the top, and you may rearrange the order of your accounts so the ones you use most frequently show up first.

The quick glance account buttons at the top of the page can be viewed in Expanded or Compact mode, depending on your preference. There is also a 3rd option called 'Totals', which aggregates all of your accounts and shows two balances: Cash and Borrowed.

All of the 1st CCU accounts for which you are a primary or joint owner will be displayed in the account list. This includes checking and savings accounts, loans, and credit cards. Depending on the viewing mode you select there will be 2, 3, or 6 account quick buttons on display at the top of your dashboard. Click on the ">" or "<" symbols below the account buttons to view the rest of your accounts.

To organize your accounts, click the "..." symbol under your profile image in the upper right corner and select "Organize Accounts", then use the six dot grid icon to the left of the account name to drag and drop the accounts into your preferred order. Click Save. To organize your accounts in the Mobile App, click the hamburger menu in the upper left and select 'Accounts'. Then hold your finger on one of the accounts until the screen shifts to an account list with two lines on the right side. Drag and drop the accounts to reorder them.

The white squares are called menu cards (or menu tiles). Menu Cards can be customized by clicking on the three dots ("...") symbol in the upper right corner of each card. Select from Small or Large card size. The Small card size displays the number of activities occurring in that category for a specific timeframe (ex: past 48 hours, past 30 days). The Large card size displays a list of the activity.

To reorganize your dashboard, click the "..." symbols within a menu card and select "Organize Dashboard" (or scroll to the bottom of the screen to select "Organize Dashboard"). If you are on a computer you can rearrange the card order by clicking the six dot grid icon to the left of the menu tile to drag and drop into the position you prefer. If you are on the mobile app, tap and then hold to drag and drop.

If you don't need to see one of the menu cards (example: if you don't write a lot of checks you may not care to see the Check Images card), you can hide the card by clicking the gray X in the corner to remove it from the dashboard. Don't worry, you can always add it back later if needed by clicking "Add A Card" at the bottom of the page. This is a great way to personalize your dashboard to fit your needs. Cards available include:

- Messages: shows you if you've received a new message from 1st CCU

- Transfers: a quick link to transfer funds

- Transactions: this card shows an aggregated list of the most recent transactions performed on all accounts, including your Primary accounts AND accounts you are Joint owner of

- Check Images: click to view images of cleared checks that you've written on your account

- Payments: another link to viewing Bill Pay activity

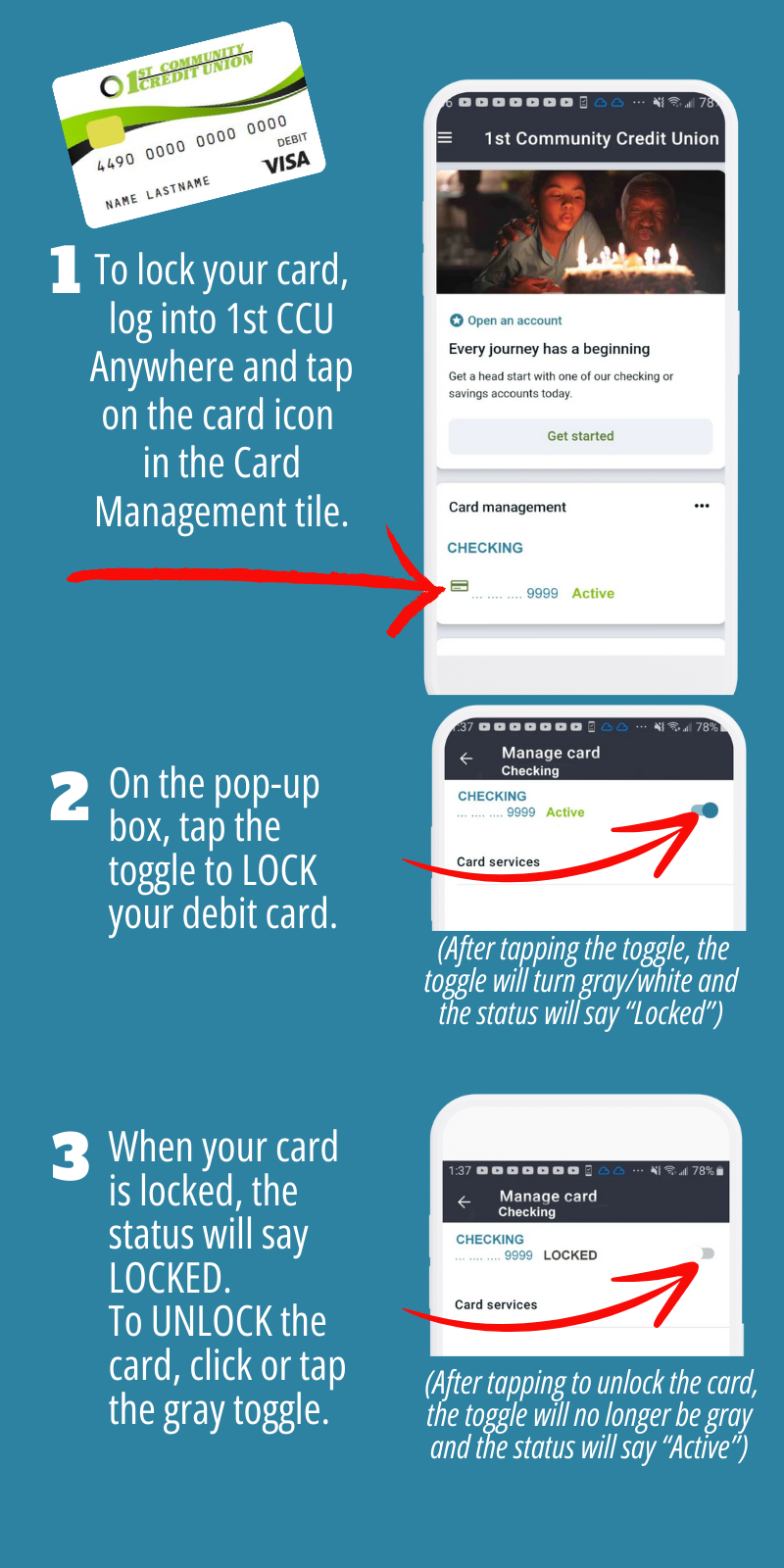

- Card Management: this is where you can turn off and on your debit card

- Support: information about how to contact 1st CCU

To personalize your dashboard you may add a photo, image, or logo to your profile. Select Profile>Settings from the lower left corner OR click on the image circle in the upper right and select "Profile". Click on the pencil icon to add an image from your computer/device. Crop or adjust the image as needed and save.

Within your Profile settings you may also edit your preferred first name, edit your address, email, and phone numbers. It is important that your 1st CCU account always have your current valid address, email and phone number(s) on file.

MOBILE APP SETTINGS:

How do I change my profile photo in the 1st CCU Anywhere Mobile App?

- Tap on the profile picture in the upper right corner to bring up your Profile

- Tap on the image icon, then choose to add a photo from your Photo Library or Take A Photo

- Click 'Allow' to allow access to the functionality on your device

- Navigate to the desired image in your gallery, downloads, etc. and select the image, OR take a photo of yourself for your profile image. The system gives you a chance to reposition or zoom the image

How do I log out of the 1st CCU Anywhere Mobile App?

When using the mobile app there is not a log out button to push. You can exit the app by going to a different app or your home screen. Each time you navigate away from the app, your active session is ended, which serves the function of a log out button. When you navigate back to the app, you will be asked to re-authenticate, and if you have quick access features such as FaceID, TouchID, or passcode log in, you can gain access quickly each time.

If you want to remove the connection between your device and your account altogether, you can go to the Menu>Name>Settings>Security>Recently Used Devices>Remove Device. This will remove all association between your account and the mobile device and app you are using. Each time you attempt to access the app after this, you will need to put in the full username, password, and 2-Factor Authentication to authorize your account on that device.

I have more than one account at 1st CCU and they are separated (they are not set up as 'cross-accounts', so the second account is not visible when I log in). How can I log into my second account on my mobile phone once I've already set up access to my first account?

You can add multiple profiles to the 1st CCU Anywhere Mobile App for your convenience. Follow these steps:

- When you tap the mobile app icon the pop-up box displays your name and asks for your password. Without entering your password, click on the dropdown arrow to the right of your name at the top of the box, then select "+Add Profile".

- Type in the Username and Password for your second account

- Get the two-factor authentication code sent to you

- Enter the code, then accept the User Agreement

- Create a new 4-digit passcode for this second account, then confirm the 4-digit passcode.

- Now that you've added a second profile, any time you tap the 1st CCU Anywhere icon on your phone to launch the app you may use the dropdown arrow at the top of the passcode box to select which profile you wish to log into, then use the correct 4-digit passcode for accessing that account.

1st CCU ANYWHERE-ONLINE SETTINGS:

How do I change my profile photo in 1st CCU Anywhere-Online?

- In the left side menu, click on your name in the bottom left corner and select Settings to bring up your Profile

- Click on the pencil icon beside your profile picture

- Navigate to the desired image on your computer, click on the picture and click the Open button. Use the mouse to position the icon window over the image, then click the Save button.

How do I log out of 1st CCU Anywhere-Online?

Click on your profile image/name in the bottom left corner of the screen, then select "Sign Out"

ADDITIONAL SETTINGS FAQ’s:

I "hid" one of my joint accounts by toggling the setting so I won't see the transactions in my transaction list. Now the account doesn't show in my account list, how can I find that account and change the setting so I can see it again?

From the dashboard or the left menu, click on your Profile, then select Settings.

In the General settings box on the left, click on "1st Community Credit Union" under the Accounts heading.

Here you will find a full list of the accounts you are Primary or Joint on, and you can click into the account and adjust the toggle so the account once again shows on your Dashboard

How do I rename or personalize an account name in 1st CCU Anywhere?

You can rename your Primary accounts by logging in, selecting the account from the Accounts section, then choosing the 'Settings' button. In the upper right corner across from the account name, select 'RENAME'. Type the new name, and then select 'SAVE'. Note: you may only change the name on accounts for which you are the Primary account owner.

How can I change my address without coming into the Credit Union?

- Log into 1st CCU Anywhere and go to Profile/Settings (either click your name on the bottom of the left menu screen OR click the profile image circle in the upper right corner).

- When Profile is highlighted in the General Settings box on the left, the Profile box will display your profile image, name, mailing address, email address, and the phone number(s) on file for your account. Simply click "edit address", "edit email", or "edit phone numbers" to get started.

- For security purposes the system will ask you to confirm your 1st CCU Anywhere Password in order to continue. Once you've typed in your password to confirm, the system will provide a field for you to change the information.

- Don't forget to click the 'Save' button! A small popup message at the bottom of the screen will inform you of the successful change to your address.

I tried to change my address but I received a message that I need to contact 1st CCU to do it. Why can't I do it online?

Certain account types are not allowed to change their address electronically (ex: Corporation, LLP, LLC, Club/Organization accounts, Estates, Rep Payee accounts, etc.). There are also other circumstances that prohibit an account from doing an electronic address change (accounts that are brand new, accounts with deceased owners, accounts with two signatures required, your loan is past due, etc). Please contact 1st CCU for assistance if you are unable to change your address in 1st CCU Anywhere.

How can I turn my 1st CCU Debit card On and Off when I have misplaced it, so it can't be used while I'm searching for it?

- Log into 1st CCU Anywhere Online or Mobile Banking

- Scroll to the Card Management menu card

- Locate the active card that you misplaced

- Tap or Click to toggle the setting off (The card is 'off' when the toggle is gray, and the card is 'on' when the toggle is blue)

If I Turn Off/Lock my Debit Card will the automatic debit transactions I have previously authorized be rejected? (i.e. streaming subscription, gym membership, etc)

Yes, at this time a locked debit card will prevent any debit card transactions, including previously-scheduled transactions.

How often will I need to change my password?

For enhanced security of your financial information the 1st CCU Anywhere system will ask you to change your password after 12 months.

How can I find out which devices have been used to log into my account?

Log into your account and go to Profile/Settings. Select Security from the list of settings to view. In the Security box you will see all recently used devices listed.

How do I make a transfer between my accounts?

- Select the Transfer icon and choose the account you want to transfer TO and FROM. Eligible internal and external accounts will be listed.

- The transfer feature includes a Memo line for your convenience. A memo can be added to an Immediate Transfer (Memo feature is not available for recurring or future-dated transfers, however if you wish you can add a Tag to transfers that will appear after the transfer posts to your account)

Can I transfer funds between accounts I am joint on?

You can make immediate transfers between your account and eligible accounts you share with joint accountholders (also called cross-accounts). You can also make immediate transfers between two accounts you are joint on. We're sorry, scheduled future transfers and recurring transfers are not available between cross-accounts.

To make a cross-account transfer, select the Transfer icon and choose the account you want to transfer TO and FROM. Eligible accounts will be listed. Type in the transfer amount, and if you would like to place a memo on the transfer transaction click on 'More options' and type the memo.

Will I be able to delete transfers once they have been submitted?

No. Internal and External Transfers cannot be deleted once they are submitted. If a transfer was submitted in error, a new transfer will need to be set up to move the funds back.

Can I delete a transfer that I have scheduled but that hasn't happened yet?

Click on the transfer, and if you see a little garbage can icon, the transfer can be deleted. Simply click the garbage can.

How can I schedule recurring transfers between my accounts?

- Click on Transfer (in the menu, using the shortcut button, or the link in the dashboard card)

- In the Transfer pop-up box, select the account you are transferring From, and the account you are transferring To

- Type in the transfer amount

- Click on 'More Options' to expand the Transfer box

- Select the Frequency of the scheduled automatic transfer you are setting up (Weekly, Every 2 Weeks, Twice a month, Monthly)

- Select the date you want the scheduled transfers to start. NOTE: Automatic scheduled transfers are made in the evening of the scheduled day. If you need the transferred funds to be in the account in the morning (for example, if you are funding an account to cover a monthly automatic insurance withdrawal) you will want to schedule the transfer to occur on the day BEFORE the automatic funds are routinely withdrawn).

Where can I find my scheduled future transfers?

- When setting up future transfers in Online Banking: View them under "Transactions" in the account (as "Scheduled Activity"), under Transfers on the left menu, or inside the 'Transfers' card on your dashboard.

- When setting up future transfers in the Mobile App: View them under "Transfers" on the left menu or inside the 'Transfers' card on your dashboard.

How do I make a Member-to-Member Transfer?

- A Member-to-Member transfer is one that you make to another accountholder at 1st CCU, into an account that you are not a joint owner of (example: a transfer of rent funds to a landlord, a transfer of funds to a friend, transferring money into your adult child's account, etc). Member-to-Member transfers can be one-time transfers or scheduled transfers.

- You will also need the recipient's member number, the first 3 letters of their last name (or business name), the account type (savings, checking, etc), and the 4-digit Share ID of the account.

- If you anticipate that you'll be making future transfers to this same account you may check the "Save for future use" box before clicking 'Next'

- Follow the prompts to set up the transfer to the Member

How do I add an account from another financial institution in order to transfer funds between them?

You can add accounts from other financial institutions so they are accessible for viewing in your account list. Keep reading for directions:

How do I pay my loan from another financial institution in 1st CCU Anywhere?

You can pay your loan from another financial institution by using External Transfers. Keep reading the next question for the steps to take.

How do I make a transfer of funds between my accounts at 1st CCU and my account at another financial institution?

- First you need to add an external account:

- Log in and click 'Transfers' (or select Transfers from the main menu)

- Click +External Account to set up a new linked account

- Enter the account information and submit

- Confirm a deposit amount into your other financial institution (NOTE: This may take 1-3 business days to arrive. There is no charge for Micro Deposits when testing a first time External Transfer)

- Please be aware that this external transfer link is only to be set up with other accounts on which you are authorized

- To verify the two trial deposits please go to: Main Menu>Primary Member's Name>Settings>External Accounts

Once an external account has been verified you may create an External Transfer.

- In 1st CCU Anywhere-Online Banking:

- Click the Transfer button and select Make A Transfer

- Choose your 'From' account

- Choose your external 'To' account

- Type in the transfer amount (External transfer maximum $2,000)

- If desired, click 'More Options' to change the frequency and date

- Click 'Submit'

In 1st CCU Anywhere-Mobile App:

- Tap on the slide-out menu

- Tap 'Transfer'

- Tap 'Make A Transfer'

- Choose your 'From' Account

- Choose your external 'To' account

- Type in your transfer amount (External transfer maximum $2,000)

- Tap 'Submit'

Is there a fee for External Transfers?

No, 1st CCU will not charge a fee for transfers made to or from External accounts.

How do I make a loan payment?

A loan payment is done by making a transfer. Click the transfer quick button on the dashboard. Select the account you want to transfer FROM, then select the loan you want to transfer the payment TO. Type in the amount of the payment. If you are scheduling a transfer for a date in the future you can click 'More Options' to select the transfer date. The system also has a field for you to type in a memo if you wish.

How can I get information on the amount I would need to make a loan payoff?

From the dashboard, click into the loan account. Click the 'Loan Payoff' button and wait for it to load the screen. Read the information provided, then use the dropdown to select the estimated date you would payoff the loan. Click the 'Calculate' button. The Loan Payoff Calculator will give you information on the amount required to pay off the loan on that date (the amount provided is an estimate, there are certain caveats that may affect the payoff amount - for an exact payoff amount please contact 1st CCU). Click the 'Done' button to return to the Loan account screen.

Please Note: A Loan Payoff cannot be done via 1st CCU Anywhere transfer.

How do I add a Note or Image to a transaction or transfer in 1st CCU Anywhere?

You can add notes and images to your transactions within the account:

- Click on any account

- Click on Transactions

- Select the Transaction you wish to edit and pull up the transactions detail page

- Click on the appropriate icon for one of the following:

- Add Notes

- Add Images

- Follow the on-screen prompts to update the transactions

- Close the transaction detail page (or in mobile, tap the < )

Any notes and images attached to transactions will be accessible on all devices when you log into 1st CCU Anywhere in the future.

Where can I view Pending Transactions on my accounts?

Log in, then select the account you need to view. To view all account activity, view the Activity Tile OR select Transactions. Transactions that are Pending will have a Pending tag in the transaction list. When viewing a full list of Transactions there will also be a separate box that lists Pending Transactions.

How do I search for a specific transaction in 1st CCU Anywhere?

You may search by amount, date, tags, key words, etc.

In 1st CCU Anywhere-Online Banking:

- Log in and click Accounts, then select the account you would like to search.

- In the Activity section, select the Magnifying Glass icon

- Click on the Search and Sorting options to open Advanced Search. On the Advanced Search window you can select specific search filters and then click 'SEARCH'.

In 1st CCU Anywhere-Mobile App:

- Log in and select the account you would like to search.

- Select 'Transactions'

- Tap the Magnifying Glass icon

- Tap the Gear icon to use Advanced Search options.

How do I download a list of transactions from 1st CCU Anywhere?

Account transactions can be downloaded in the 1st CCU Anywhere-Online environment (downloads not available from the mobile app):

- Log In

- Click ACCOUNTS

- In the Accounts section, select the account you would like to download the transactions for

- In the Activity area select the download icon next to the print and search icon

- On the Download Activity window, select the Date Range and File Type and click Download

How do I print transactions from 1st CCU Anywhere?

Account transactions can be printed in the 1st CCU Anywhere-Online environment (not available from the mobile app):

- Log In

- Click ACCOUNTS

- In the Accounts section, select the account you would like to print the transactions for

- In the Activity area select the printer icon (only transactions that show in the Activity section will print)

- A print screen appears with a print preview and print configuration options

- Configure the print settings and select Print

How do I apply for a loan in 1st CCU Anywhere?

When you apply for a consumer loan within 1st CCU Anywhere, some of the loan application forms pre-fill with your information, saving you time. Prepare for a fast and easy loan application experience! It takes just minutes to apply, any time, anywhere, and on any device.

- Log into 1st CCU Anywhere on your computer or your mobile device

- Select 'Apply for a loan' from the left menu

- Click or Tap to select the type of loan you need (Credit Card, Vehicle Loan, Personal Loan)

- Follow the prompts and fill out the loan application form fields that have not pre-filled.

- After submitting your application you'll receive a confirmation notification.

- You can also check the status of your consumer loan application by logging back into 1st CCU Anywhere, click 'Apply for a loan', and select the Check Status button.

The 1st CCU Bill Pay service provides you with a convenient method of paying your bills online.

- Convenience: No checks to write, no envelopes to stuff, no stamps to buy, no trips to the post office

- Send payments to anyone, anywhere in the USA with a click of the mouse

- Schedule payments in advance; one-time payments, automatic payments, or recurring payments

- Payments deducted from your 1st CCU account

- Account-to-account transfers

Sign up for Bill Pay within 1st CCU Anywhere by logging in and clicking on the 'Pay' quick access button

- You must have a Share Draft account

- Your accounts must be in good standing*

- You must read and agree to the Terms and Conditions

- Fees may apply

*The funds need to be available in your account on the scheduled Process Date which is 2-5 business days prior to each bill's actual Due Date. If the funds are not available on the process date, you will incur NSF Fees. In addition, the payment will be cancelled, which may result in you receiving late fees from the payee.

How Do I Pay A Bill In 1st CCU Anywhere?

If you are enrolled in 1st CCU's Online Bill Pay service:

- Select the Pay button from the dashboard

- Select a merchant or person you would like to pay

- Select an account to take the funds from, and then input the amount

- If you would like to set the date for the payments, select MORE OPTIONS and select the desired date

- Select SUBMIT

- (if you are not enrolled but you would like to enroll, click or tap the Pay button - restrictions may apply and more information can be found on our website by selecting the Bill Pay page under the Services menu)

How Do I Pay A Person In 1st CCU Anywhere?

- Select the Pay button from the dashboard

- If it is your first time using Payments, it will ask you to enroll, click Enroll

- Select Pay a person > Person to pay, click to 'Add another person'

- Choose the payment method: Direct Deposit to the payee's account (payment electronically deposited into your payee's account), Email (your payee receives an email to accept payments) or Check (Sent by mail to the payee's address)

- Follow the prompts and fill in the necessary information about the payee (name, phone number, account type, routing number, account number)

- For security purposes you will be asked to confirm your password

- Select the person to pay

- Click on Make A Payment

- Select an account to take funds from, and then input the Amount

- If you would like to set the date for the payment or set up frequent payments, select 'More options' and select the desired date. You can also add a comment.

- Select Submit

How Do I Set Up A New Payee For Bill Pay In 1st CCU Anywhere?

- Select the Pay button from the dashboard

- If you are in 1st CCU Anywhere-Online, when the Pay A Bill box pops up click on the "+Add another bill" link at the bottom of the box and follow the prompts to set up your payee.

- If you are in 1st CCU Anywhere-Mobile, when the Bill Pay screens pops up, click on the "+" (plus sign) in the upper right corner and follow the prompts to set up your payee.

eStatements are faster, simpler, more secure, and better for the environment.

- eStatements: eStatements are archived within 1st CCU Anywhere and you may print them, save them on your personal computer, or leave them stored in the archive. Each statement cycle you will receive an email reminder when your statement is ready to view. Statements are archived for 18 months.

- eNotices: Your eStatement enrollment also includes storage for any eNotices you may receive. If you receive an email that an eNotice is available to review, log into 1st CCU Anywhere Online or Mobile Banking and click on the 'Documents' button, then select the subtab for the eNotices to view your notice. One example of an eNotice would be a notification that your Share Certificate or IRA Certificate is coming due soon.

- eTax Documents: If you are enrolled in eStatements with 1st CCU you'll also receive any applicable tax forms electronically. Account holders who are not signed up for eStatements will receive any tax forms in the mail.

- If you earn $10 or more in dividends on your 1st CCU funds during the calendar year you will receive an eTax Form

- If you paid $600 or more in mortgage interest at 1st CCU during the calendar year you will receive an eTax Form

- When eTax forms are ready to view you will receive an email (email is sent to the primary member on the account via the email listed on the account in our computer system)

How do I sign up for eStatements?

- It's easy to enroll in eStatements! After logging into 1st CCU Anywhere, click on an account in your list and then select the 'Settings' button from the menu at the right.

- In the Settings activity box, click the ENROLL link next to 'Documents'.

- Click the checkbox next to 'Enroll all accounts' and click the Save button.

How can I view my statements?

To view your statements, select 'Documents' from the menu or button options. If you are currently not signed up to receive eStatements, you have the option to enroll once you've selected 'Documents'. eStatements open in PDF format.

What do I do if I want paper statements?

We encourage members to try out eStatements, but if you find that you would prefer paper statements you may unenroll:

- Click on your name in the lower corner of the left menu

- Select 'Settings'

- Click '1st Community Credit Union' on the left side of the white pop-up box

- Your list of accounts will come up, and you can click into any account (for example, Checking). Inside the account details at the bottom where it says 'Documents', select the arrow to go into the Documents settings. To Unenroll in eStatements you can Uncheck the "Enroll All Accounts" box and then click 'Save'.

eAlerts

- Receive notification of account activity via in-app message, text message, or e-mail.

- Change your alerts whenever you wish.

- eAlerts are a free service. Setting them up is quick and easy. See our tutorial video!

eAlerts are near-real time, which means they may take a few minutes to reach you.

Your credit union does not charge for eAlert Texts, however, depending on the rate plan with your mobile service provider, you may incur charges when receiving texts. Please consult your mobile device's service plan for details.

eAlerts are sent to the email address and/or mobile phone number listed on your account. To receive an SMS Text Alert you must have a valid mobile phone number listed in the 'Mobile' field under your Profile. To edit the email or phone number, click on the image circle in the upper right corner to go into your Profile and make the necessary changes to bring your contact information up-to-date.

In-App Message Alerts show up as a new message in the Message menu within 1st CCU Anywhere

Security eAlerts:

- Log into 1st CCU Anywhere via Online Banking or the Mobile App

- In the left menu, click on your name at the bottom (to reach the left menu on Mobile click the three lines at the top left)

- When you've clicked on your name, select 'Settings'

- Select 'User Alerts' from the Settings Menu

- You'll see a list of your Security Alerts - these alerts are required and are provided for security purposes. The Security Alerts default to sending an email to the email address on your account when a new change has been made to your profile:

- Login from a new device

- Username changed

- Email address changed

- Mobile phone changed

- Password changed

- Security eAlerts by email are required, and you can also ADD alternative forms of notification if you prefer. Tap the alert type, then tap or click to toggle if you wish to also receive Security eAlerts via Text (SMS) and/or In-App Notification. Click the Save button to save your changes.

Along with convenient Security eAlerts you also have the ability to set up eAlerts for each account you are a Primary owner of. The eAlerts available are Balance Alerts and Transaction Alerts.

Balance eAlerts:

- In the 1st CCU Anywhere Online Banking or Mobile App, select the account for which you'd like to add an eAlert by tapping or clicking the account (Example: Checking)

- Click 'Alert Preferences' in the menu (mobile) or click the Alert Preferences button (online)

- In the Alerts box you may set up your eAlerts:

- In the Balance Alerts section, select 'Add Alert'

- Select Above or Below, and then input a dollar amount (round up to the nearest dollar)

- In the 'Notify By' field, select Email, Text Message, and/or In-App Message

- Select 'Add Alert' to save the alert

- Repeat this process to add Balance Alerts to your other accounts as needed

- The Balance Alerts are triggered by a transaction (i.e. a deposit or a withdrawal)

- The Balance Alerts are sent one-time only, on the day a transaction triggers the alert. (Example: If you set an alert to be notified when your account balance falls below $100, you will receive an alert on the day your balance falls below $100, but you will not receive alerts on the following days. Only when your account balance is brought up above $100 and then falls below $100 will you receive the alert again)

Transaction eAlerts:

- In the 1st CCU Anywhere Online Banking or Mobile App, select the account for which you'd like to add an eAlert by tapping or clicking the account (Example: Checking), then select 'Alert Preferences' in the menu (mobile) or use the button (online)

- In the Transaction Alerts section, select 'Add Alert'

- Set up the eAlert(s) to be sent to you when a Credit Transaction (a deposit) is above the dollar amount you specify, or when a Debit Transaction (a withdrawal) is above the dollar amount you specify.

- In the 'Notify By' field, select Email, Text Message, and/or In-App Message

- Select 'Add Alert' to save the alert

- Repeat this process to add Transaction Alerts to your other accounts as needed

- The Transaction Alerts are triggered by a transaction that meets the threshold you have set up

- The Transaction Alerts are sent one-time only, on the day a transaction meets the threshold

eAlert Maintenance:

To Edit An eAlert:

- Select the account you would like to edit an alert for

- Click 'Alert Preferences' in the menu OR 'Manage Alerts' in mobile

- Under Alerts, click 'Edit' on the right side of the alert, make the adjustments to the alert, then click Save

To Delete An eAlert:

- Select the account for which you would like to delete an alert

- Click 'Alert Preferences' in the menu OR 'Manage Alerts' in mobile

- Under Alerts, click 'Edit' on the right side of the alert, then select Remove

How do I send a Secure Message in 1st CCU Anywhere, and who answers the Message?

There are a few ways to securely send a message to, or communicate with, a 1st CCU Call Center Representative. In the 1st CCU Anywhere platform the terms Message and Start A Conversation are interchangeable:

- Click the Message button on the dashboard and type your question in the bottom of the New Conversation window

- You can also click on 'Messages' in the main menu and click on the "Start A Conversation' button, then type your question in the New Conversation window

- To ask a question about a specific transaction from the transaction list, or about a specific account from the account list:

- For questions about a transaction: Click on the transaction to open the Transaction Details window, then click the 'Ask us about this transaction' link. The system will give you the choice to Start A New Conversation (if it's a new question about the transaction), or Add To A Conversation (if you have already been messaging a Call Center Representative about the transaction.

- For questions about an account: Click on the account to open the Account Details menu, then choose 'Ask us about this account'. The system will give you the choice to Add To A Conversation or Start A New Conversation.

- In the Conversation window, type your message and click Send.

- The messages are monitored during business hours by the Call Center Representatives, who will respond shortly.

The 1st CCU Anywhere Mobile App is convenient for depositing checks remotely (available in the mobile app only)

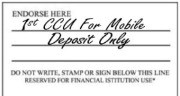

Use the approved endorsement "1st CCU For Mobile Deposit Only" on the back of the check (do NOT sign your name on the back of the check)

- Log into the 1st CCU Anywhere Mobile App on your device.

- Tap the 'Deposit' quick access button (or select 'Deposit Checks' from the left menu, then tap 'Make A Deposit').

- Type the amount of the check when prompted, then click 'Continue'.

- Tap on the account you wish to deposit the check into. (click 'allow' if prompted)

- Lay the check on a flat surface - front side up - and position your mobile device directly above the check when taking the pictures, rather than at an angle.

- Tap anywhere on the screen to take a picture of the check front.

- If the picture is clear and centered, click 'Continue'

- Turn the check over and take a picture of the check back.

- Click 'Continue' if the picture is clear and centered.

- Verify the information and click 'Submit' if everything is correct.

- Once the check images are successfully submitted you will receive confirmation that the deposit is being processed and in most cases your account will be credited by the end of the next business day.

By using Mobile Deposit you agree to securely retain the original check(s) for a period of at least 30 days after transmission to 1st CCU, and to safely destroy the original check(s) after a period of at least 30 days.

Mobile Deposit Requirements

- You must be 16 years or older

- Your account must be open at least 45 days

- You must have an email on file with the credit union

- The checks you are depositing must be made payable to an account holder on your account. You may not deposit checks made payable to a third party.

- Deposits may be made to your Savings, Ultimate Share, Share Draft, or Money Market account

- You should retain the check for at least 30 days after the deposit has posted to your account. After 30 days has passed, please shred the check to securely dispose of it.

- Mobile Deposit is disabled if your account has been negative for 30 days

- You must use the 1st CCU Anywhere Mobile App to make a Mobile Deposit

- You must use the approved endorsement "For 1st CCU Mobile Deposit Only"

- Qualifying accounts that may qualify for Mobile Deposits:

- General Membership

- Revocable Trust

- Sole Proprietor accounts

- Ineligible accounts that may not do Mobile Deposits:

- State-restricted

- 2-Signature

- Custodian

- Guardianship

- Rep Payee

- Certain Business accounts

- Ineligible Checks may not be deposited, including:

- 3rd-party checks

- Foreign checks

- Altered checks

- Previously deposited checks

- COMCHEKS

- RapidDrafts

- Bonds

- Travelers checks

- Money orders

- Rebate checks

- Stale or post-dated checks

- See the Mobile App page on our website under the Services tab for Terms & Conditions. Your continued usage of Mobile Deposit indicates your acceptance of the terms.

Mobile Deposit Limitations

- Per Deposit: Dollar Limit is $3,000.00 and number of checks deposited via Mobile Deposit is limited to 5

- Per Day: Dollar Limit is $3,000.00 and number of checks deposited via Mobile Deposit is limited to 5 (NOTE: In most cases your account will be credited by the end of the next business day)

- You must have an email address on file at 1st CCU

- Mobile Deposit will be disabled if the account has been negative for 30 days

- Additional restrictions may apply

- Only the approved endorsement can be written on back of checks being deposited

- Supported devices include all iOS devices with a camera and operating system version 16.0 or newer, and all Android devices with a camera and operating system version 8.0 and newer

Mobile Disclaimer

We are not responsible for any errors or failures from any malfunction of your mobile device, the browser or software. You are responsible for the security and security settings of your device. 1st Community Credit Union is not responsible for any virus or related problems that may be associated with the use of any online system.

Your credit union does not charge for Mobile Banking, however, you may be responsible for data charges on your device. Depending on the rate plan with your mobile service provider, you may incur charges when accessing the Internet. Please consult your mobile device's service plan for details.

Make Sure The Mobile App Is Up To Date On Your Device

If you have difficulty accessing Mobile Banking, please make sure that you are using an up-to-date software on your phone and the most current version of our app.

- The app's Version 3.28 will roll out in October 2025. The minimum supported version of our mobile app will be 3.25.

DEVICE REQUIREMENTS:

- Apple devices must be running iOS 17.0 or higher.

- Android devices must be running Android 9 (API Level 28) or higher.

-

If your device does not meet these requirements, you can continue accessing your accounts through our web application or mobile browser. Thank you for keeping your app updated and secure!

WHAT THIS MEANS FOR YOU:

Update Your Phone Software = If you are using older, outdated software you may receive errors when attempting to access the 1st CCU Anywhere app. It may be time to update to a newer, supported version of your software.

Update App = If you are using an older, outdated 1st CCU Anywhere app (older than version 3.25) you may receive errors when attempting to access the app. Updating ensures you have access to the latest enhancements, security protections, and performance improvements. We strongly encourage you to turn on automatic updates so your 1st CCU Anywhere Mobile App always stays current.

Can I open a new savings account in 1st CCU Anywhere so I can set aside money for a specific goal?

Yes, this is a self-service option available to you in 1st CCU Anywhere! You may open an Ultimate Savings (minimum opening deposit of $1000, earns a higher dividend unless the balance falls below the $1000 minimum) or a Secondary Share account (a convenient way to save for something specific such as pet expenses, braces, vacation, wedding expenses, a down payment on a home, etc)

- Log into 1st CCU Anywhere

- On the dashboard's left menu, click on your name and select the 'Add An Account' option

- A new window will pop up where you can select 'Open a subshare'

- Select the share type by clicking the checkbox, then click the 'Next' button

- Click the checkbox next to the option provided and click 'Next'

- Read the Terms and Conditions documentation provided before clicking the 'Agree & Continue' button. (TIP: if you are using a smart phone you may need to hold your finger down on each of the three terms and conditions links and then authorize the phone to open the link in a browser tab)

- Place a check in the checkbox next to 'Electronic transfer' to authorize the transfer of funds to fund the new account, then click 'Next'

- Use the dropdown to select the account you want to transfer FROM to fund the new account, then type the dollar amount you wish to transfer to the new account (subject to minimum). Then click 'Next'

- On the final screen please verify the information, and if it is correct click the 'Confirm' button to open the new account

Can I renew a Certificate, add funds to a Certificate when it renews, or transfer a Certificate to a savings account when it matures?

Yes, you may be able to add funds or transfer a maturing Certificate. This must be done BEFORE the Certificate reaches maturity. (The 10-day grace period is not available for Certificate funds transfers authorized AFTER maturity in 1st CCU Anywhere. If you implement changes to a Certificate after the maturity date it will authorize the changes to be added to the NEXT maturity date, not the current maturity date.)

Follow these steps:

- Log into 1st CCU Anywhere

- On the dashboard, click on your Certificate account from the account list

- On the account details screen, select the CD Renewal button

- A new window will pop up where you can see the Maturity Date of the certificate (Remember, changes must be made before the maturity date)

- Use the dropdown box to select what you would like to happen when the Certificate matures (Increase Certificate Balance or Transfer Certificate Balance)

- Fill in the fields requested to tell the system what you would like to do (please carefully read all instructions)

REMEMBER: if you are adding funds to a Certificate at renewal, the transfer of funds will happen on THE DAY BEFORE the maturity date of the certificate, so you will need to make sure the funds are available in the 'transfer from' account on the day before the maturity date.

Read the final screen carefully to verify that the information is correct, then click the 'Submit' button

Can I renew a Certificate for the same term without making any changes?

If no changes are desired and you want to renew your Certificate for the exact same term, no action is required. The Certificate will automatically renew. You will receive a notification of the renewal via eNotice (if you are enrolled in eStatements) or by mail.

How do I reorder checks in 1st CCU Anywhere?

Checks can be reordered by logging in, clicking on the Checking Account you need checks for, and selecting 'Order Checks' from the menu (mobile) or the buttons (online). Select the check style, verify the address information and starting check number to be printed on the checks, etc. During checkout, enter your email address, verify the shipping address, and click to choose the shipping method you prefer. When the information is correct click the 'Place Your Order' button.

How can I opt into the service where 1st CCU pays overdrafts on my ATM and one-time debit card transactions so my card isn't denied if I don't have sufficient funds?

If you want 1st CCU to authorize and pay overdrafts on ATM and one-time debit card transactions, you may Opt In within 1st CCU Anywhere by clicking on the word 'Accounts' in the left menu. On the Accounts screen you will see a small box on the right side and the last option in that box will be 'Overdraft Options'. Click 'Overdraft Options' and read the information provided. Click the checkbox to enroll and click the 'Next' button, continue reading the disclosures, click 'Agree & Continue', then read the final disclosure and click the 'Submit' button.

How do I access the 1st CCU Credit Card Online Account Management website in 1st CCU Anywhere?

- Log into 1st CCU Anywhere

- On the dashboard click on your Credit Card (or select 'Accounts' from the left menu and then select your credit card)

- In 1st CCU Anywhere Online, select the Credit Card shortcut button on the right to go to the Online Credit Card Management site

- OR, in the mobile app select 'Credit Card' from the menu after clicking into your Credit Card account

- The Online Credit Card Management system will display the Account Summary screen. On this screen you will be able to view your credit card balance, your available credit, your CU Reward Points, and more.

Click here for a detailed guide to navigating Online Credit Card Management

Which Internet browsers are supported?

Our 1st CCU Anywhere Online platform supports the current and prior major release of the browsers listed below. Please note that utilizing old browsers may result in limited functionality or limited access to Online Banking services.

- We recommend downloading the current version of Google Chrome, Microsoft Edge, or Firefox. Safari can also be used. (Internet Explorer should not be used)

- In general, compatible browsers include the two most recent major releases of:

- Microsoft Edge

- Firefox

- Safari - Apple/Mac Users only

- Google Chrome

The following types of tools and/or access are not recommended and may impact experience:

- Accessing accounts via an embedded browser such as:

- Personal or Commercial Financial Management Software (Quicken, QuickBooks, etc)

- Browser bars within AOL, Yahoo, Google, etc

- Internet portal access within gaming system such as xBox

- Use of browser add-ins (emoticons, FunWeb services, etc)

- Beta versions of browsers

Update Your Browser

If you are using an older, outdated browser you may notice issues when viewing and using newer websites that are created under newer website development standards. It may be time to update to a newer, supported version of your favorite browser.

In some cases it may be necessary to clear your cache, reboot, or try logging out and logging back into your computer or device.

Mobile devices such as tablets or smartphones may not perform at optimal levels and some functionality may be lost when using a mobile device to log into Online Banking. We recommend our mobile app for tablets and smartphones.

Make Sure The Mobile App Is Up To Date On Your Device

If you have difficulty accessing Mobile Banking, please make sure that you are using an up-to-date software on your phone and the most current version of our app.

- The app's Version 3.28 will roll out in October 2025. The minimum supported version of our mobile app will be 3.25.

DEVICE REQUIREMENTS:

- Apple devices must be running iOS 17.0 or higher.

- Android devices must be running Android 9 (API Level 28) or higher.

-

If your device does not meet these requirements, you can continue accessing your accounts through our web application or mobile browser. Thank you for keeping your app updated and secure!

WHAT THIS MEANS FOR YOU:

Update Your Phone Software = If you are using older, outdated software you may receive errors when attempting to access the 1st CCU Anywhere app. It may be time to update to a newer, supported version of your software.

Update App = If you are using an older, outdated 1st CCU Anywhere app (older than version 3.25) you may receive errors when attempting to access the app. Updating ensures you have access to the latest enhancements, security protections, and performance improvements. We strongly encourage you to turn on automatic updates so your 1st CCU Anywhere Mobile App always stays current.

What do I need to know if my loan is past due?

If you are delinquent on your 1st CCU loan your ability to perform certain functions within 1st CCU Anywhere will be temporarily disabled, including but not limited to, making an electronic loan payment, transferring funds via external account transfer, opening a subaccount, putting a stop payment on a check, changing the contact information in your profile. If there is something you need to do while your loan payment is past due, please contact 1st CCU directly for assistance.

Why can't I see the images of my cleared checks?

If you are unable to view your cleared check images it's possible that your device is set up to not allow cookies on our site, or your computer may be set up to clear cookies at each logout.

Why am I getting the error "Your account needs attention"?

This error presents itself during the log in process and typically means that your account has been locked. This can happen for a variety of reasons, but is easily resolved. Please contact 1st CCU for assistance in unlocking your account by calling 888-706-1228 during regular business hours for assistance.

Why am I getting the error "Please verify your information and try again"?

This error is present during the log in process and typically means that your credentials didn't match our records. Try entering your credentials one more time. If the error persists, please contact 1st CCU at 888-706-1228 during regular business hours for further assistance.

Why am I getting the error "Incorrect Phone Number"?

This error is present during the enrollment process and means that the phone number you entered does not match the phone number we have on file. If you have an alternative phone number, you can try again. If you would like to update your phone number in our system or you need other assistance, please contact us at 888-706-1228 during regular business hours for assistance.

Why am I getting the error "Oops, the information you provided doesn't match what we have on file"?

This error is present during the log in process and typically means that your account information does not match our records. Please contact 1st CCU at 888-706-1228 during regular business hours to confirm that we have the correct phone number and username on our records.

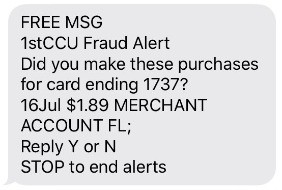

Automated Fraud Alerts are specific to your Credit and Debit card transactions. Our card processor provides constant monitoring, and if a suspicious transaction is identified on your account we will attempt to contact you about the activity via SMS text, phone, or email to determine if a transaction was authorized by you. This is a free service.

If you made the purchase and you respond as such, the verification that the transaction is not fraudulent will go a long way toward preventing unnecessary blocking of your card

If you did not make the purchase your card can be blocked quickly to prevent further fraud and limit the hassle of disputing multiple transactions.

You do not need to register for this service, but we ask that Credit Card and Debit Card holders please notify 1st CCU when you change your mobile phone number, cell service provider, or email address so we can keep your contact information up-to-date in our computer system. Help us help you prevent fraud!

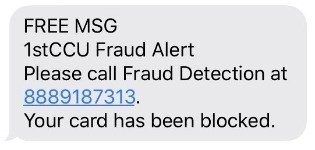

IMPORTANT: Please remember that when you receive a 1st CCU Automated Fraud Alert we will never ask you to provide your account info, passwords, or other sensitive information. The Fraud Alert you receive will ask if you made a specific purchase transaction. You will only need to respond with a simple Yes (Y) or No (N) to the text, email or voice message, and we will take the appropriate action (See the sample text images below). If you aren't certain if the message is authentic, please contact 1st Community Credit Union at 888-706-1228 to learn more.

Notification Steps Contact Pattern:

The free text is the first attempt to notify you. The text displays the transaction amount, last four digits of the card number, and abbreviated merchant information.

- If you did authorize the transaction you should reply with a simple "Y" text

- If you didn't do the transaction you should reply with "N"

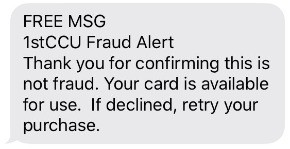

- If you respond to the text with a "Y" you will receive the confirmation text shown below:

If you respond with "N" you will receive the text shown below confirming that your card has been blocked to prevent further fraudulent use, and directing you to call the toll-free number to speak with a Card Services agent regarding the fraud.

Digital Calls Are The Second Step, and Email Is The Third Step:

- If the text message is not answered within 30 minutes, a digital call is made to the mobile phone and a message is left if not answered.

- If no response is received within 30 minutes, a call is made to the home phone.

- If no response is received to any of the above attempts, an email is sent to the email address on file.

What if I do not have text messaging?

You will still receive automated fraud alerts via phone and email. A text messaging plan is not required, but is a great way to receive fraud alerts about your 1st CCU account.

How do I opt-out of text alerts?

To opt-out of text alerts, simply reply STOP to any text alert. You will no longer receive fraud alerts via SMS message. You may also opt-out by calling the number provided on the back of your card and asking to be opted out of Automated Fraud Alerts messages.

What happens if the transaction in question in the fraud alert is legitimate?

If you recognize all of the transactions present in the fraud alert. Simply reply “Y”, to confirm the activity as valid. Your card will automatically be unblocked and no further action is required. You may now complete any purchases that may have been declined.

Are the text commands case-sensitive?

No. Commands can be sent as upper-case, lower-case or a mixture of both.