Overwhelmed When It Comes To Cybersecurity?

It can be hard to know where to start! The National Cybersecurity Alliance (NCA) recommends starting with the "Core Four" - a set of four steps anyone can focus on to get you started:

- Use Strong, Unique Passwords: Use long and unique passwords for each of your accounts. One great tip is to use a passphrase, which is a string of multiple words (including a mix of letters, numbers, and special characters) that's easy to remember but hard to guess. Don't try to remember all your passwords - let a password manager do the work for you. These tools generate strong passwords, store them securely, and fill them in when you log in to your accounts.

- Use Multi-Factor Authentication: Even the strongest passwords aren't perfect. That's where multi-factor authentication (MFA) comes in. Also known as two-factor authentication or two-step verification. MFA adds an extra layer of security by requiring something in addition to a password - such as a code sent to your phone, a fingerprint, or security key.

- Allow Automatic Updates: Allowing your software and apps leaves them vulnerable to cybercriminals. When companies discover weaknesses and flaws in software and apps, they release updates to fix them. If you delay installing updates to your devices and apps, you're leaving the door wide open for attackers to exploit these known vulnerabilities that the update would have fixed. The easy solution is enabling automatic updates on your devices, apps, and accounts to ensure security fixes are applied in the background.

- Spot and Stop Social Engineering (Scam) Attacks: Not all cyber attacks are initiated by savvy hackers - Cybercriminals often rely on simply manipulating people. This is called social engineering and it includes attacks like Phishing Emails, Fake Text Messages, and Phone Calls - all designed to trick you into clicking a link, downloading malware, or sharing your credit card information or password. Watch for these Social Engineering Red Flags:

- Urgency: "Act now or lose access!"

- Too good to be true: "You've won a prize!"

- Requests for sensitive information: "Provide your online banking login credentials to receive your bonus."

When in doubt: STOP. THINK. ASK YOURSELF "COULD THIS BE A SCAM?" Don't click links, don't give out information. If you are concerned that a text, email, or phone call might be true, always visit the official website or call the company using a known phone number listed on an invoice or statement to independently verify.

PLEASE READ: Are you being coached by someone (via phone, online, or someone you just met) to open a new account? Fraudsters often coach victims to open a new financial account to receive fake "winnings". They may tell you that the purpose of the new account is to protect your "winnings", or to keep a wire transfer or "tax/fee payments" separated from your existing personal account, but ultimately the real purpose is an attempt at gaining control of your account and stealing your identity or your funds. Don't become a victim.

Latest Scams in 2025: Here's what we've learned...the longer you talk to a scammer, the more you open yourself to further attempts to scam you. It's best to disconnect immediately. Hang up, delete the text or email. When you engage with them in any way via phone, text, or email (even if it's just to 'give them a piece of your mind') you are showing the scammers that you are a potential target. Be smart, don't interact with them at all.

- Social Media Scam Ads That Link To Spoof Shopping Sites: $20 name-brand shoes? NO, it's a scam. The most popular social media shopping scam this holiday season is advertising brand-name products at unbelievably low prices through deceptive ads which lead to fake websites which steal your credit or debit card number and other information when you try to take advantage of their fake 'deal'. You don't get the item (or they ship you a cheap knock-off) and your card account is compromised and in jeopardy of additional fraudulent charges. Don't become a victim!

- With the surge in scammers using AI the fake ads look real, but don't be fooled into clicking the links in the ad.

- When shopping online, research and visit the store's legitimate website URL.

- Be skeptical of prices that are too good to be true.

- Avoid pressure tactics. Stop and Think. Ask yourself, could this be a scam?

- Friendly reminder: Never give out unnecessary information such as bank account number, PIN, or one-time access codes.

- Publisher's Clearing House Scams:

- Scammers have resurrected the old Publisher's Clearing House scam, most likely due to consumers looking for a windfall in the current economy. Calls, text, or emails claiming to be coming from Publisher's Clearing House are fake. Red flags to look for include (1) asking you to send money to receive your 'winnings', (2) asking for payment via non-traceable gift cards, cryptocurrency, or wire transfers, (3) pressure to act fast, (4) you don't remember entering the sweepstakes, (5) they ask for personal information, or they ask you for your financial account number or your online/mobile banking user name and password, claiming that they need the info to deposit your 'winnings'. Don't fall for it!

- Financial institution impersonators:

- If you receive a phone call claiming to be from a financial institution and requesting private information (online banking user name and password, authentication codes, account numbers, PIN numbers, etc), never give out that information. A legitimate representative of your financial institution will not call you to ask for these credentials.

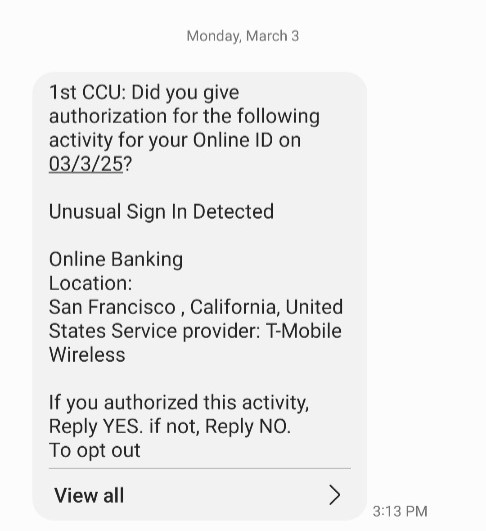

- 1st CCU does NOT send text messages for online banking that include links, phone numbers, or opt in or opt out requests. Some scam texts include a phone number, and when you call the number the fraudster says 'your account was exposed' and they may even tell you they are connecting you with a 'federal investigator' who directs you to access your online or mobile banking while doing screenshare (Don't do it! Doing so would give them access to your login credentials).

- Or they try to create a sense of urgency, pushing you to open a new account through THEIR process or else your account funds will be frozen for 6 months.

- Hidden text in emails that fools Google Workspace's Gemini:

- Google Workspace with Gemini is being manipulated in an unusual way by some cybercriminials. You receive an email that appears ordinary, and doesn't have any suspicious links or attachments. But if you ask Gemini to summarize it, Gemini's summary of the email shows you urgent warnings about your password being compromised, and a support phone number to call to resolve the problem. This urgent alert is fake. Cybercriminals have embedded hidden text in the email that can't be seen by you but is picked up by Gemini. If you called the 'support number' a cybercriminal would answer and try to trick you into giving them your account's login information. Don't trust security alerts that show up in an AI-generated summary. Real Google security alerts won't appear in a Gemini summary.

- Computer takeover:

- This is still happening. Your computer gets taken over because you clicked a link or an ad or a post in social media. The hacker gives you specific instructions for sending them a 'ransom money'. They may request that you mail them cash, purchase gift cards and give them the card numbers, or purchase bitcoin to pay for access to your computer.

Stop and think before you do anything. Ask yourself "Could this be a scam?" Never give out confidential information, including online/mobile banking user name and password.

For more examples of Scams and Fraud, see the section below titled 'Scams Take Many Forms'.

Spot and Stop Attacks - Clues To Look For:

- Urgency: If the message creates a sense of urgency, it's because the sender is trying to trick you into rushing a decision, taking quick action, or making a mistake. An example of Urgency would be a sender/caller claiming that your debit card will be deactivated if you don't give them your card number and validate the card information immediately.

- Fear Tactics: If someone is threatening to arrest you, sue you, or subject you to other consequences if you don't pay them, it's likely a scam.

- Pressure: An example of an attacker applying pressure would be someone claiming to be from the company you work for, pressuring you to ignore or bypass company security policies to give them access to information.

- Unusual Payment Methods Requested: If you are asked to send a prepaid card, gift card, cryptocurrency, or other unusual form of payment, or even a wire transfer, don't do it. Payment methods that are nearly untraceable are preferred by scammers, and once the money leaves your hands, it's usually gone for good.

- Pre-Payment Requested Or Required: Anyone who offers you a prize or debt relief if you pay an upfront fee or shipping costs is scamming you.

- You Need To Keep It A Secret: If you have been asked to keep a financial transaction secret, you're likely being scammed. Scammers don't want you to talk to friends, family members, or your financial institution's employees because they are afraid the scam will be detected.

- Curiosity: Any message that generates a tremendous amount of curiosity or seems too good to be true, such as an undelivered UPS package or a notice that you are receiving an Amazon refund, is suspicious and likely a cyber attack.

- Tone: When you receive an email or phone message from someone claiming to be your friend, family member, or coworker, but the "tone" of the message is wrong (the wording or phrasing doesn't sound like them). Don't fall for it. If you feel that you need to double-check the validity of the message, do NOT call a number or click a link in the message. It can even be risky to call them directly, as their phone may have been stolen and the cyber attacker could answer it.

- Sensitive Information: Any message requesting sensitive information, account numbers, or passwords and other login credentials is a scam.

- Generic: You may receive a message from a trusted organization, but the message is generic such as starting with "Dear Customer". This is likely a phishing attack.

- Personal Email Address: Any email that appears to come from a legitimate organization, merchant, or co-worker, but is using a personal email address like @gmail or @hotmail is not legitimate.

The security of today's technology can be overwhelming, especially for family members who may be new to using mobile devices and apps, such as grandparents or young teens.

The best way to help your family stay secure is by making security as simple as possible for them. It is important to also share information on scams with older family members, college students, and friends. Scammers prefer to prey on the elderly and young people who are managing their own finances for the first time, often resorting to harassment if they feel it will get them the information they desire. Work together to come up with a plan of what to say and do if they are contacted with requests for sensitive information. Taking a few steps can have a big impact:

- Explain that scammers and con artists have been around for hundreds of years, they are just using the Internet now to try to fool their victims.

- Give examples of how scammers target their victims by pretending to be a government agency, financial institution, utility company, etc.

- Be sure that family members understand the importance of never giving out sensitive personal information, account numbers, passwords, or remote access to their computer.

- Explain that the more urgent the message seems (whether it is a text, phone call, or email) the more likely it is a scam.

- Let your family members know about romantic scams also, explaining that con artists prey on people who are lonely and longing for love by pretending to be their match made in heaven.

- Let your loved ones know that they can contact you any time they are unsure about an email or phone call.

- Emphasize that scammers also still utilize phone and mail scams. They can still become victims if they don't know the warning signs. It's important to always be cautious of any unsolicited contact, even if the call or letter appears to be coming from a legitimate company or organization.

- When setting up Home Wi-Fi access for anyone who is new to technology, take the time to make sure their wi-fi is password-protected. Consider using a secure form of DNS service that can help stop people from visiting infected websites. For younger family members, restrict websites that you don't want them to have access to.

- Help your less tech-savvy family members keep their devices and systems updated and current. This makes it harder for scammers and hackers to compromise them. The simplest solution is enabling automatic updates.

- Inform family members about the importance of using secure passwords that are unique, and coach them to not use the same password across multiple sites.

- Mistakes can happen. Make sure reliable backups are in place and be sure that your loved ones know what to do and who to contact if they fall victim to a scam.

Beware Of These Recent Scam Tactics

- Publisher's Clearing House (and similar sweepstakes prize) Scams: Scammers try to convince you that you've won a prize. They may ask you to send them money to pay for taxes, processing fees, etc. This is a scam. According to the Federal Trade Commission, it is illegal for a sweepstakes to require you to pay to receive prize winnings. OR, they may ask for your financial account numbers or online/mobile banking login credentials, which they claim they need so they can deposit your 'winnings'. Please be aware that Publisher's Clearing House declared bankruptcy in early 2025, and the original company is no more. Do not believe calls, texts, or emails claiming that you're a big winner.

- Cryptocurrency Scams: Beware of Cryptocurrency Scams in which someone claiming to be a cryptocurrency teacher or professor befriends you to help you learn how to invest in cryptocurrency. The scammers typically communicate via text messages, social media, or dating apps. Over time they establish a relationship of trust with their victims, then weave cryptocurrency into the conversation. They often don't ask for money directly, but they offer to guide you through cryptocurrency investment strategies. Many of these scammers work with an 'assistant', and they may invite you into a private group of other investors, who are mostly also in on the scam. You start by sending a small amount to a cryptocurrency exchange. You are presented with false account updates showing that your account is growing, and the scammer may allow their victim to cash out a small portion of the initial investment, just to gain their trust. Then they start pressuring victims to send more and more money (this is the slaughter element of the pig butchering scam). When the victim attempts to make a second cash-out of their investment, they are told they must first pay huge fees or taxes, or that they can't withdraw until they've reached '100 points' on the system's credit platform. Building points requires more and more deposits, and they basically make it impossible to reach that threshold. As soon as the victim has no more money to invest in the cryptocurrency the 'teacher' breaks contact and goes on to his next victim. Due to the nature of blockchain transactions, it is extremely difficult to recover funds you've lost from a cryptocurrency scam. There are countless stories of victims losing their life savings to this scam. Don't fall for their tactics.

- Fraudsters Claiming To Be Cartels: These scams involve threatening texts and/or phone calls claiming to be the cartel or the mob. The caller demands money, threatens to harm the victim's family members, or may even claim that they have already kidnapped a loved one. They may tell you that they know your address/names/ages of your family members. (They generally dig up this information online or social media). They may send you graphic photos to coerce you into sending them money. This is a scam. Hang up the phone immediately. Call the police to report the threatening phone call if you feel you are in danger, and provide details about the content of the call. Do not withdraw cash, do not wire funds, do not buy gift cards.

- Cash Grab Scam: Someone calls you claiming to be a representative from a big retail company. They warn you that criminals have taken over your account and are using it for illegal activites. You are told that you will be transferred to a government agent who is investigating the account. The agent claims that the criminals have also compromised your bank account and they have access to all your money. The agent tells you that they will protect the money in your account if you withdraw the cash from your bank or credit union and give it to a courier. The agent also claims that your mobile device and computer are compromised and you should avoid telling anyone what you're doing. Spoiler alert: The original 'retail company' caller and the 'government agent' are both scammers. There is no compromised account or illegal activity on your retail company account. The only way your money will be gone forever is if you withdraw it from your credit union or bank account and give it to the scammers. Stop, Think, Ask yourself "Could this be a scam?". Be suspicious of anyone who calls you with wild claims, uses fear and urgency to get you to act immediately, and asks you to keep information secret from your family, spouse, financial institution, or the police. These people do not have your best interests in mind, they are after one thing...your hard-earned money.

- Anti-Virus Notification scams are on the rise again. The fake virus alert uses urgent language with phrases such as "Critical threat!" or "Your computer is infected!"

- The fake alert may come via email or text, or it may result from clicking on an ad or button on a website or in social media.

- The alerts often resemble legitimate antivirus software. Be wary of notifications that appear on your screen without you initiating a computer scan or update.

- These types of scams often include a link. Do not click any links as they may lead to malware.

- The virus notification could also include a phone number, and typically when you call the number you are told that you must send money or withdraw cash from your financial institution and wait to be called for further instructions.

- Or you may be asked to allow remote access to your computer.

- No matter which direction the scam takes, the scammer becomes increasingly urgent and demanding in their attempt to get hold of your hard-earned money.

- Never give out any personal information.

- Don't click any links.

- Don't download any software.

- Take appropriate steps to determine if your computer actually has a virus. If you aren't sure how to do this, consult a family member or friend or a local computer expert.

- Brute-Force BIN Attacks On Debit Cards: These attacks are happening to debit cards in financials nationwide. Brute Force is a tool that uses a trial-and-error method to guess card number combinations, security codes, and expiration dates. A BIN Attack uses the Brute-Force tool to guess valid combinations of credit or debit card information, and once the computer identifies a working combination they proceed to test the card by making a small purchase to determine if the card is active and vulnerable to fraud. Typically these will be used for purchases with online retailers, especially online retailers that don't require a 3-digit security CVV code to complete the purchase. Ways to protect your card and your funds include locking your debit card when you aren't using it, and setting up eAlerts to notify you whenever a transaction hits your account so you can determine if it's a transaction you authorized. If you need assistance with locking your card or setting up eAlerts, our Call Center (888-706-1228) and 1st CCU Team are available to help.

- Phone Takeover Scam: This scam involved an online purchase. The website where the purchase was made was likely a spoof website. The purchaser received a phone call after the purchase was made and the scammer convinced the purchaser to give access to her phone. The scammer immediately took control of the phone, gained access to where she had passwords saved, then took over all of her accounts including her email. If someone has taken control of your phone, contact your financial institution immediately for assistance in locking down your financial accounts, debit, and credit cards so the scammer cannot initiate fraudulent transactions.

- Facebook Password/Help Desk Host App Scam: This is a scheme where a scammer, posing as a legitimate Facebook support representative, claims to be helping you fix a technical issue (such as trouble changing your password), then they trick you into downloading and granting access to a remote desktop application (such as Help Desk host app) to gain control of your device. In one known incident the scammer also instructed the victim to log into their online banking. Granting someone access remotely can lead to them taking control of your device, stealing your passwords and contact information, and locking you out of accounts.

- Microsoft Help: This scam involves the victim receiving an unsolicited phone call requesting personal information and banking information. Never respond to these types of inquiries. A legitimate Microsoft representative will never reach out asking for sensitive information over the phone, especially not your banking details.

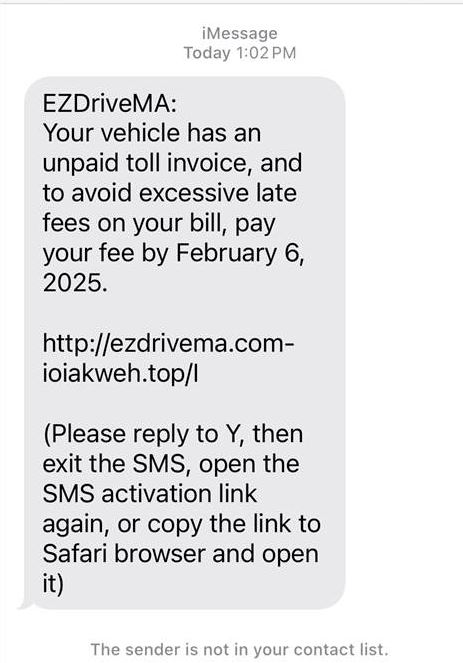

- iMessage Phishing: A scam that's getting a lot of attention right now, hackers have found a way to disable Apple's phishing protections on the iMessage platform. Normally the phishing protections gray out links in texts if the links are found to be malicious. The scammers are now utilizing the feature that asks you to text a "Y" or "N" response if you want more information, but responding can disable your iPhone's iMessage phishing protection. When iPhone users respond with a "Y" to the phishing text, they receive a text with a link that is not grayed-out, which gives them a false sense of security that the link can be trusted. Clicking on a malicious link can lead to a spoofed website that steals personally identifiable information. Malicious links can also install malware on your device and download spyware or ransomware.

- Financial Institution Spoofing. These scams take several forms but usually involve a text claiming that you had fraudulent charges on your 1st CCU account. 1st CCU did not send this text. These can be very tricky because they claim to be sent by the financial institution you trust. 1st CCU does NOT send text messages for online banking that include links, phone numbers, or opt in or opt out requests. Some of the scam texts include a phone number, and when you call the number the fraudster tells 'your account was exposed' and they may even tell you they are connecting you with an 'FDIC investigator' (credit unions don't go through FDIC) who directs you to access your online or mobile banking while doing screenshare (giving them access to your login credentials). They try to create a sense of urgency, pushing you to open a new account through THEIR process or else your account funds will be frozen for 6 months. ALWAYS contact the credit union directly by phone or in person or via secure messaging within online/mobile banking if you are concerned about a text or phone call you've received. NEVER follow the directions of someone on the phone when they tell you to screenshare, when they tell you to download a special app to your phone, or any other request that raises red flags. Stop and think before you do anything. Ask yourself "Could this be a scam?", "Why do they want me to act immediately instead of going to the credit union to sort this out?", etc. Never give out confidential information, including your online/mobile banking user name and password. If you receive suspicious messages or calls please contact 1st CCU directly before responding or clicking a link. Below is just one example of what a fraudulent text might look like, but please be suspicious of any text that claims to be from your financial institution and asks you to call, visit a website, or text a response.

- Unpaid Toll Scam: In this scam the victim receives a text about an unpaid toll. Do not reply to the text and do not click the link included in the text. This is a scam. Most toll agencies do not send payment requests via text message.

- Parking Ticket Scam: In this recent new scam the scammers create realistic-looking parking citations and place them on the windshield of vehicles, misleading the owners into believing they have been legitimately ticketed. The fake tickets typically include logos and detailed information that make then look authentic at first glance. They also have a QR Code that the 'violator' can scan to pay the 'fine'. Consumers see that the fine listed on the fake ticket is low and they want to get it taken care of right away, so they scan the QR Code, visit the designated website listed on the ticket, or they call the phone number on the fake ticket to provide their payment details. This puts them at risk of identity theft and financial loss.

- PayPal Attacks: Cyberattacks targeting PayPal users have been persistent for a while now. Some of them still use the phishing attack methods, while others have evolved to employ sophisticated techniques such as credential stuffing attacks. Cybercriminals use automated tools to attempt logins on accounts, using login credentials obtained from previous data breaches. Once they gain access, they initiate unauthorized transactions on the PayPal account.

- AI-aided Phishing Scams Targeting Business Execs: This advanced phishing scam has become the starting point for over 90% of successful cyberattacks, leading to substatial financial losses. Scammers, aided by AI bots or Deepfake technology, craft a highly personalized and believable phishing email that is specifically designed to deceive high-level executives. Attackers may exploit current events, company news, or urgent situations to create a sense of urgency and pressure the exec to act quickly without verifying that the message is legit. The goal of these attacks it to trick the executive into revealing sensitive information or transferring large sums of money.

- SEO Poisoning: Hackers have found ways to turn Google searches into malvertising (a scam ad that installs malware or brings you to a bogus website when you click on it).

- "Brushing" Scam (featuring QR Code Hacking of your Phone): Have you received a package you didn't order? CAUTION: The scammers who send the package often include a QR Code inside the box. They want you to scan the QR Code to see the name of the person who sent the package or where the 'gift' came from. DO NOT SCAN THE QR CODE! If you scan the code it can download malware to your smart phone and access/hack the information on your phone.

- "Brushing" Scam (featuring Fake Review): Another form of the brushing scam is when a scammer sends a package to your home without your permission, then the company posts a fake positive review for the product using your name. Why? Because the goal of a brushing scam is to increase the popularity and/or rating of a product to get more sales. The package they send is often an inexpensive item such as beauty products, household goods, or gadgets.

- What should you do if you receive a strange package?

- Never scan a QR Code contained inside the package

- Check around to see if it's a gift sent to you by family or friends

- If you didn't order it and it wasn't a gift, report the package. You can report it online to the sending company or contact their customer service

- Monitor your accounts. Keep an eye on transactions for several months to make sure no one is using your account. If you notice suspicious activity, report it to your financial institution right away. You can also consider requesting new cards and account numbers.

- Change your password on Amazon, and consider changing passwords and setting up two-factor authentication on your online shopping and banking accounts.

- What should you do if you receive a strange package?

- Police Phone Call Scam: A scam call circulating in the Wisconsin area consists of citizens receiving a call that claims to be coming from the local police or sheriff's office. The caller claims that you have unresolved legal matters, and the caller tries to get information or even funds from you. Law Enforcement and other Police and Sheriff's office employees will never ask for payment over the phone. Hang up on these calls. Never give out information to unsolicited callers.

- AI Scams: AI stands for Artificial Intelligence, and cybercriminals have discovered just how convincing AI can be in helping them trick you into sending them money.

- Scammers can fake an entire Video Call

- Imagine receiving an email claiming to be from your company's Chief Financial Officer asking you to do a financial transaction for the company. You are wary, but you join a video call to discuss the request. The video call looks and sounds exactly like the CFO, so after the meeting you feel convinced that the financial request is genuine and you send the payment as requested. However, it turns out scammers have used AI Technology to create believable video and audio of the Chief Financial Officer. This is called a deepfake.

- Scammers can Clone Voices of Loved Ones

- With "voice cloning" tools a scammer can use a simple snippet of your loved one's voice (lifted from a video on your loved one's social media account, collected from a voice mailbox recording, or obtained by recording a spam call made to the loved one). The audio sample is run through an AI program that replicates the voice, including laughter, fear, or emotions. This allows the scammer to enter text of anything they want the voice to say, and you end up getting a panicked phone call from your loved one asking you to do a cash app transfer to cover an emergency medical bill or auto repair.

- How can you protect yourself?

- Be suspicious of any unexpected phone calls.

- If you receive a call from an unknown number, don't answer it.

- If you do answer, let them speak first. Be aware that anything you say can be recorded.

- Never give out any information.

- Beware of Caller ID spoofing, which creates a fake Caller ID on your phone.

- The scammer's number could show up as a number that you recognize, such as a government agency or a well-known company.

- Hang up if you're suspicious, then look up the legitimate phone number of the person, agency, or company and call them directly to verify the authenticity of the caller.

- Never wire money or pay with a gift card. Legitimate companies will not ask you to do this.

- Be careful what information you share online. Social media is a fun way to connect, but it's essential to protect yourself from scammers, hackers, and identity thieves.

- Educate older and younger family members so they can protect themselves, too.

- Be suspicious of any unexpected phone calls.

- Scammers can fake an entire Video Call

- Cybercriminals posing as Amazon support and sending notifications claiming your Amazon account is on hold due to billing errors. The scam email includes a link to 'resolve the issue' by updating your billing info.

- Cybercriminals use Facebook Messenger to ask you about your business. The message includes an attachment, which installs malware if you download or select the attachment.

- Per the FBI, Callback Phishing Attacks are on the rise. Cybercriminals send an email claiming you have a pending charge on one of your accounts, but if you call the number provided in the email the cybercriminal will guide you on how to connect with them through a legitimate system management tool (i.e. remotely connecting to your computer or device and controlling your device). Once the legitimate software has been installed, cybercriminals can use it to sneak ransomware onto your device, resulting in your sensitive information being stolen or used to extort you or your organization.

Be suspicious of unexpected emails, particularly if they include an attachment or link, or if they ask for personal or financial information, OR if you are asked to call a number. If you are concerned that the claims in the email may be true, always navigate directly to the secure website of the company to find the best contact number and make a direct call instead of trusting the phone number in the email.

More Scams To Be Aware Of

More information about these types of scams can be found on the Federal Trade Commission website: consumer.ftc.gov

- Password theft or Online Banking Login Credentials theft

- Fake shopping websites

- Free trial offers

- Scam texts or emails claiming debit or credit card is blocked

- Scam phone calls claiming security check

- Fake fraud alerts

- Amazon phone scam

- Paypal invoice scam

- Netflix (or other streaming) scam

- Online lending scams

- Gift card scams

- Fake work-from-home scam

- Fake CDC or World Health Organization emails for new vaccines

- Government check scams

- Phishing emails, texts or phone calls

- Fake investment scams

- Fraudulent check/Mobile Deposit scam

- Grandparent scam

- Law enforcement or Hospital emergency phone call scam

- IRS scams

- Payday Lender scam

- Zoom Installer scam

- Computer Tech Support or Computer Takeover scam

- Microsoft scam

- Fake letter from lawyer claiming inheritance

- ATM Skimming device scams

- Utility company scam

- Fake smart phone apps

- Fake charity or holiday-related websites

- Fake delivery notices

- Fake Facebook “new friend request” messages

- Online Romance scams

- Auction site fraud

Bottom line, be vigilant and protect your hard-earned funds at all times. If something doesn’t seem right, end it. Log off the computer, delete the email or text, stop responding to phone calls…do what you need to do to protect yourself, your identity, your accounts, and your sensitive personal information.

Be cautious of QR Codes:

It's important to be extremely cautious of QR Codes because scammers can create fake QR codes that install malware on your phone or redirect you to phishing websites, potentially giving them access to steal personal information such as login credentials or credit card details.

- If you receive a strange package that you didn't order and you find a paper inside that directs you to scan the QR Code to find out who sent the 'gift', DO NOT SCAN THE QR CODE.

- If you are out in a public place and you see a sign advertising an event or an exclusive discount offer, never scan the QR Code. Scammers can stick fake QR Codes over legitimate codes on unattended public signs and posters.

Protect Yourself From Fraud and Scams

We can't stress this enough - Never Give Out Sensitive Information:

- Never give anyone your Online Banking or Mobile Banking/Mobile App user name or password.

- Keep your account numbers, credit and debit card numbers and PINs, and social security number private and secure.

- If you receive a phone call, text or email that includes a request for this sort of sensitive personal or financial information, hang up or ignore the call or delete the text or email.

Be Smart, Be Safe

- Pay Attention To Account Activity: Online Banking, Mobile Banking, Online Credit Card Management, eAlerts, and P.A.T.T. Telephone Banking are offered free of charge to 1st CCU members. Use these free resources often to monitor your account activity.

- Consider asking a Member Service Representative to place a Password on your account as an extra level of protection. Once you've placed a secure password on your account you will give the password anytime you request information or transactions on your account in person or over the phone.

It’s your responsibility to monitor your accounts daily, weekly, or monthly. Notify your financial institution immediately if you think you may have been scammed, or if you notice ANY suspicious transactions on your account or on your cards.

Protect Your Debit & Credit Cards

- You can LOCK your debit card or credit card via 1st CCU Anywhere Online or Mobile Banking if you have misplaced the card or if you fear that the card has been compromised.

- If your credit card has been compromised or lost, call 1-800-449-7728 to report it. They will assist you and arrange to issue you a new credit card.

- If your debit card has been compromised or lost, you may contact 1st CCU at 608-269-8121 or toll-free at 1-888-706-1228 during business hours to report it and to request a new card. We can now print you a new ready-to-use debit card within minutes, so you no longer need to wait up to 3 weeks for your new debit card to arrive in the mail.

- After business hours, please call 1-800-449-7728 to report a lost or stolen debit card.

Educate Children and the Elderly

Young people and the elderly are vulnerable to scams.

- Older adults are often less tech savvy, isolated/alone, and may not be aware of the tricks scammers play via social media.

- Young people are vulnerable because they often have a heavy online presence, less financial literacy, and they may fall for scams offering easy money.

- Scams target all ages, and scammers use different tactics for different ages.

- Talk to your children and elderly family members about scams, fraud, and identity theft.

WHAT IS AI EXTORTION? Perpetrators use AI to put your teen's face (downloaded from social media accounts) onto intimate photos. They then contact your teen with the photos to blackmail them, instilling fear that the fake photos will be sent to friends and family or public forums. Talk to your children about scams tactics such as these, and let your child know that they can always approach you about suspicious texts and threats.

Beware of suspicious calls and text messages claiming to be coming from 1st CCU.

- Be cautious when it comes to phone calls or messages you don't recognize.

- 1st CCU employees will not ask for your account number, debit card or credit card information, login credentials, etc. Anyone who asks for your Username or Password or other senstitive information does not have your best interests in mind.

- NEVER share your online banking login information. Only YOU should know your Online or Mobile Banking User Name and Password. Also, never share the authentication code sent to your phone via text or phone call. This is sent as a result of an attempted login to your online banking. When shared, it allows a scammer to log into your account. Allowing anyone to log into your account can lead to fraudulent withdrawals or other activity that compromises your funds and your account information.

- If you find yourself in a situation where you have shared your online or mobile banking credentials, contact the credit union as soon as possible.

- Protect Your Device: Every consumer who owns a computer, smart phone, tablet, or other internet-enabled device should understand what software and systems they have and configure them securely.

- Use Strong Passwords: When you use the same User ID and Password across several websites you increase your risk. Use strong, unique passwords and don't recycle the same passwords for multiple online accounts.

- E-mail is not secure: Never send your personal information via e-mail. Contact 1st Community Credit Union directly in person or by phone if you have questions about your credit union accounts. If you receive an e-mail or phone call from a business or an individual claiming to be affiliated with 1st Community Credit Union, do not give out any personal information. 1st Community Credit Union will never ask you to verify your personal information through e-mail. Question any suspicious or "official-looking" emails or letters, especially those requesting personal information to reinstate account access, claim a prize, or verify information. Never enter any of your Credit Union account numbers in response to an e-mail you receive. Be suspicious of unexpected emails, particularly if they include an attachment or link, or if they ask for personal or financial information, OR if you are asked to call a number. If you are concerned that the claims in the email may be true, always navigate directly to the secure website of the company to find the best contact number and make a direct call instead of trusting the phone number in the email.

- Never respond to job offers you receive via unsolicited e-mail: This is one of the most prevalent scams in the past couple of years.

- Never share private information, financial account numbers, or login credentials with someone who claims to be your internet boyfriend or girlfriend. This is another frequent scam. Anyone you've met on the internet who asks you to help them purchase airfare to come visit you or help them pay off debt or pay fines to get them out of trouble is scamming you. It doesn't matter if you've talked to them in person, if you've been communicating with them for a long time, or if you feel they are your soulmate - if they are asking you for money or account access they are scamming you.

- If you receive an unsolicited check in the mail, bring it directly to 1st CCU, along with a copy of any correspondence that accompanies the check. We will help you determine if the check is fraudulent.

- ALWAYS shred when throwing away documents that contain personal, financial, and sensitive information.

- NOTE: If you receive an email that claims to be from 1st Community Credit Union asking you to click on a link and enter personal information, please do not respond to the email and never give out your account number, social security number, or other personal information by email or telephone.

Security Awareness Newsletter - "I'm Hacked, Now What?"

Go to main navigation