Strong Students Make Strong Communities Strong Businesses Make Strong Communities Strong Families Make Strong Communities Strong Organizations Make Strong Communities Community is our middle name, and we feel strongly that when communities thrive we all succeed! Strong Students Make Strong Communities Strong Businesses Make Strong Communities Strong Families Make Strong Communities Strong Organizations Make Strong Communities Community is our middle name, and we feel strongly that when communities thrive we all succeed!

In early 1961 a group of individuals met and decided there was a need to provide low cost credit to all persons in the Sparta Community. One of the immediate reasons for organizing this Credit Union was to solve the credit problems of patients and employees of Sparta's St Mary's Hospital. To help the Credit Union get a good start and to encourage thrift among the hospital workers, the hospital administration gave each of its 90 employees a $5.00 Credit Union share as a Christmas present in 1961.

The credit union started small in 1961, occupying shared space in an insurance office and employing only a part-time manager.

In 1963 the credit union moved into a larger office in downtown Sparta and recognized the need for a full-time manager. An experienced businessman was looking for a change of activity, so he proposed that the credit union hire him with the understanding that he would not be paid unless the credit union grew to a point at which it could afford a full-time manager. It wasn’t long before he was receiving a paycheck.

- 1980: West Salem Branch opened with one full time employee

- 1981: Name changed from Sparta Community Credit Union to 1st Community Credit Union

- 1985: Sparta branch moves from downtown Sparta to a new building on West Main Street

- 1994: West Salem branch moves into a new building at its current location

- 2004: Sparta branch moves to a new larger building at its current location

- 2009: 1st CCU celebrates its 10,000th member

- 2015: Student Branch opens at Sparta High School

- 2019: 1st CCU’s Field of Membership expands. We now serve 14 counties in Wisconsin: Monroe, La Crosse, Buffalo, Trempealeau, Eau Claire, Jackson, Clark, Wood, Adams, Juneau, Sauk, Richland, Crawford, and Vernon.

- 2020: Tomah branch office opens

- 2023: The loan processing staff moves into the building next to the Sparta branch.

- 2023: West Salem office is renovated to improve layout

The hometown credit union that was started with a handful of members has now been serving our local communities for over 60 years. We have grown to over 15,000 members and assets over $260 Million.

We pride ourselves on being a progressive, member-owned full service financial institution dedicated to serving the community. As we’ve continued to grow we have implemented more electronic options, including telephone banking, online banking, mobile banking, online account opening, and electronic delivery of statements and account alerts. We are confident in our ability to continue providing the friendly, personalized service we have become known for.

Throughout the years, many things have evolved: our logo, our locations, our products and services, and our staff. But one thing that has remained steady since the credit union was formed in 1961 is our commitment to serving our local communities. We strongly believe that when the community is thriving, we all succeed. Our employees live and volunteer in the communities in which they work. We love our members, thank you for being part of our credit union family!

Join Us!

Calendar of Events

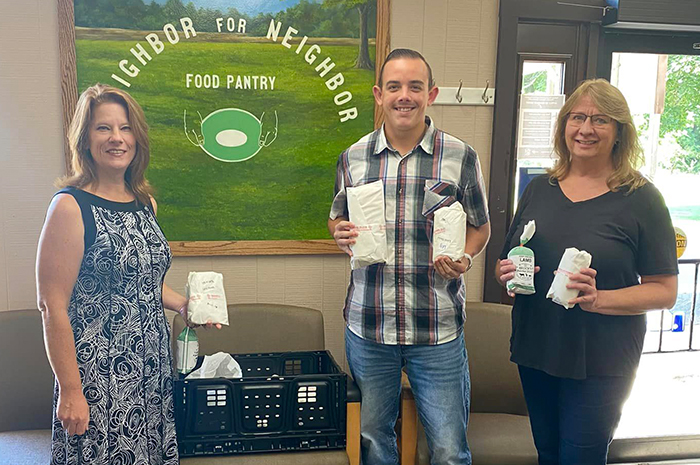

Community Is Our Middle Name

Every member and every community we serve is important to us! Our employees live and volunteer in the communities in which they work.

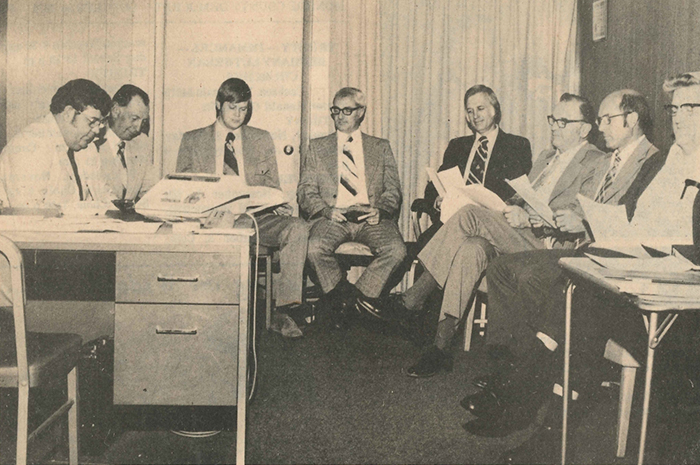

Your Board of Directors

Wendy Whitehead

Board Chairperson

Doug Billings

Vice Chair

Phil Yahnke

Treasurer

Lindsey Preston

Secretary

Doug Allen

Director

Mike Roeske

Director

Claire Sweet

Director

Meet the Management Team

Brad Bauges

President/CEO

Sandy Anderson

VP Human Resource

DeDe Mack

VP Operations

Wendy Swanson

VP Finance

Mike Lorenz

VP Member Experience

Krista Wilson

VP Lending

Jon Cook

VP Marketing

Chris Krueger

Branch Manager-West Salem

Colleen DaSilva

Branch Manager-Tomah

Ian Lexen

Branch Manager-Sparta